Content

Understanding the financial trajectory of your trucking business, saving on taxes, and bookkeeping your expenses are all crucial business-end operations. With a wide range of trucking-specific features, DAT recommends the ATBS RumbleStrip product suite to help steer you on the right path. ATBS knows truckers are busy, and expenses are high – that’s why they’re here to help you save time and money with bookkeeping, tax, and consulting services. Bookkeeping service is one of the most important aspects of running any business. As a truck driver or an owner-operator, you may find it challenging to keep up with your financial records while on the road. Our bookkeeping service is tailored specifically for owner-operators and truck drivers to help by keeping track of income and expenses on a monthly and annual basis.

The trucking industry is large and it has lots of growth opportunities. Many businesses are looking to expand, but they need professional assistance with bookkeeping to do that. That’s where bookkeepers like me who know the industry (like me and the people I’ve coached) come in to help. Using a trucking management software that is linked to your ELD streamlines your IFTA and IRP prep. When a trip is entered as a dispatch, the route computes the miles per state, which is confirmed by your ELD. You don’t have to worry about overpaying or underpaying your taxes. Keeping up with your IFTA data is one of the most important parts of running a trucking business.

Services for Truckers & Transport Companies

Providing your documents should be as easy as sending in pictures, scanning and emailing them, or mailing them to the bookkeeper. This is one of the most well-known accounting apps for trucking management software for a reason. It’s a simple-to-use, all-in-one accounting platform that includes many useful features such as income and expense tracking, mileage tracking, and invoicing.

It allows you to keep your financial statements organized and gives you an idea of how your business is performing. As a truck driver, you may have a hard time keeping good records while on the road.

Best practices for trucking bookkeeping

Integrating your tax filing with your bookkeeping can save time and ensure accuracy. Bookkeeping and tax services specially designed for trucking companies also make it easy to access and complete all required tax forms for your business.

The practice of recording each https://www.bookstime.com/ transaction a company entity does from its inception to its closure is known as bookkeeping. Each financial transaction is documented based on supporting paperwork, depending on the type of accounting system the company uses. That’s right—all those little slips of paper you keep in your glovebox are important to your trucking business! And you should be documenting them for your finances on a regular basis. As an owner-operator, however, bookkeeping is an important part of running your trucking business. Understanding bookkeeping helps to give you a clear picture of your business’ performance and be prepared for when tax time rolls around. Let our team of professional bookkeepers take care of your books and receive accurate, detailed reports every month.

Quicklook: Best Trucking Bookkeeping Services

Whichever program you choose, make sure that it offers the features that are most important to you so that you can get the most out of it. In addition, a good consultant will have a network of contacts in the trucking industry, which can be invaluable when it comes to finding new customers or suppliers.

- While it’s not as well-rounded as the other options on this list, its most popular feature can help improve your bottom line.

- I can help you make smart decisions that will make your life easier and increase your profits in the long run.

- But that also means that someone can steal your funds without going into a bank.

- ATBS offers a variety of business growth features, like profit planning, monthly financial snapshots, and benchmarking your performance against other owner-operators.

- Using a trucking management software that is linked to your ELD streamlines your IFTA and IRP prep.

- Many bookkeeping services online help with tax preparation for truck drivers.

A good truckers bookkeeping service will be able to use this information to help you figure out where to make adjustments in your business to both earn and keep more money. I can express with ease the professionalism,attention,and step by step help in obtaining the authority for our company to operate, by the helpful and professional staff from TBS.. I would encourage any independent truckers who’s applying for their authority to take full advantage of TBS’s professional expertise and one stop shop business approach in this field.

Make managing your taxes a breeze

This can lead to significant savings, especially for businesses that use a large volume of fuel. This agreement establishes a standard set of rules for reporting fuel usage and taxes paid. This helps to ensure that you are never caught off guard by a large tax bill.

- There are several potential pitfalls that new businesses of trucking can face, from regulations and compliance to managing a fleet of vehicles.

- This can make it difficult to keep track of their finances and maintain accurate records, which are essential to maintaining a successful business.

- As you can see, there are several different bookkeeping software programs available that offer different features.

- In addition, a bookkeeping service can also help to prepare owner-operators’ taxes, ensuring that they comply with all tax laws.

- As a truck driver or an owner-operator, you may find it challenging to keep up with your financial records while on the road.

However, there are limits on how much you can deduct, so it’s important to familiarize yourself with the IRS rules before claiming any deductions on your taxes. Make sure you save all your receipts, whether they’re for truck repairs or tolls. Otherwise, you could end up mixing up your expenses and deducting personal expenses on your taxes, which could get you into trouble. This may seem like a no-brainer, but it’s important to keep your personal and business finances separate. Trucking companies have a lot of expenses, from fuel costs to maintenance and repairs. Have your taxes prepared and filed without paying more than you owe. We have even more solutions to help with tracking, bidding and budgeting.

Company

Our team will help you with all the paper work your transportation company needs, this way you can get home after long hours on the road and spend quality time with your family. In addition, they offer a ton of other services, to make sure that I am dotting every I and crossing every T with the various regulatory agencies, both state and federal.

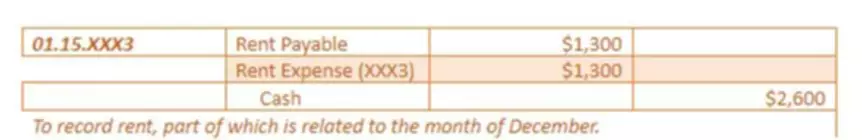

What are the three golden rules of bookkeeping?

Take a look at the three main rules of accounting: Debit the receiver and credit the giver. Debit what comes in and credit what goes out. Debit expenses and losses, credit income and gains.